This type of payment uses tokenization, which replaces your sensitive card data — like the expiration date and card verification value (CVV) — with a unique, random token. If the company you’re buying from doesn’t have your sensitive card information, neither will hackers that hit that merchant with a data breach. Fraudsters can use the stolen information for unauthorized transactions, identity theft, or resell the data on other platforms. The scale of this leak underscores the persistent vulnerabilities in global payment systems. The card skimmer illegally captures the credentials of cards inserted into the machine. The stolen data is then used to create fake credit or debit cards and commit fraudulent transactions.

This blog will delve into the recent surge of data breaches, examining the causes, consequences, and crucial steps we can take to protect ourselves. And all payments stakeholders can visit Visa’s website to see public reports and press releases regarding malware, indicators of compromise, mitigation, and protection. Stolen card data is being leveraged in many ways on the dark web, adds Rogers.

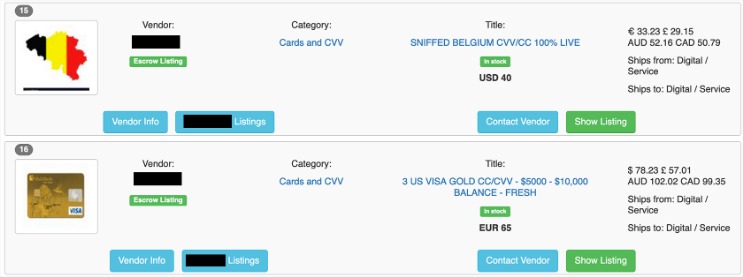

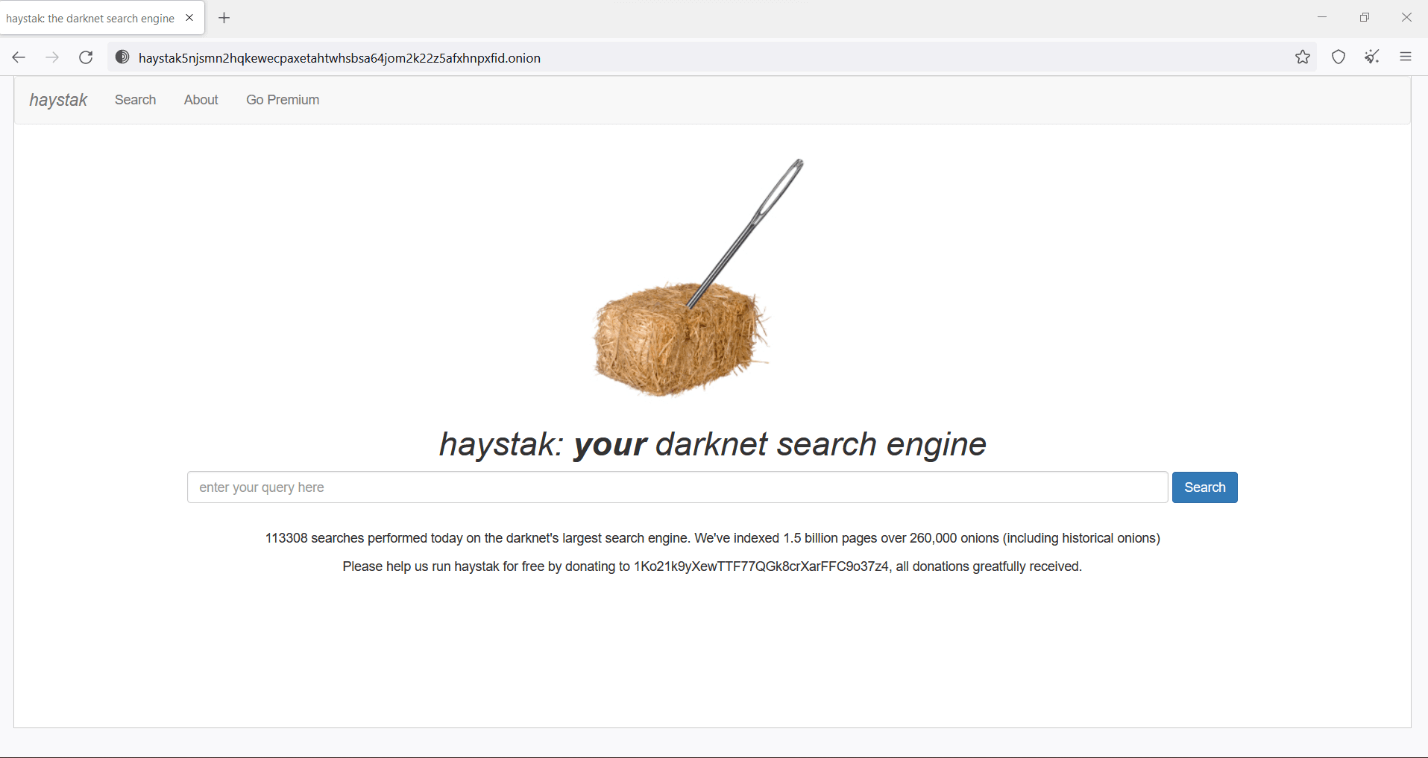

A fair number of vendors include access to a SOCKS5 internet proxy that can be used by the buyer to match their computer’s IP address location with that of the cardholder in order to avoid being blacklisted. By clicking “Continue” I agree to receive newsletters and promotions from Money and its partners. I agree to Money’s Terms of Use and Privacy Notice and consent to the processing of my personal information. One of the largest known underground shops, Joker’s Stash, generated more than $1 billion before getting shut down in February, according to Gemini Advisory. A 2019 data leak of another shop, BriansClub — which appears to have been by a competitor, according to Threatpost —shows how pervasive this trend has become. He said it felt more like a “victimless crime” because he thought most people would end up getting their money back anyway.

Magnetic Stripe Data Dumps

The latest threat intelligence analysis, however, suggests those numbers are low. Over 400,000 of the compromised credit cards were used for online transactions, with hackers making purchases on popular e-commerce sites. Kaspersky further advised, in all but the last case, existing endpoint protection platforms are capable of detecting, mitigating, and removing infostealer malware that can lead to credit card data ending up on the dark web. It’s illegal to buy or sell stolen credit card numbers on the dark web or anywhere else.

Customers who lose their card data to fraud may turn to a different card while waiting for a replacement card, threatening the top-card effect of passing all spending across one preferred card. In some markets, like the US market, those interchange fee revenues can approach 3% of all transactions. Simultaneously, customers face the risks of identity theft, damaged credit scores, and the emotional toll of financial fraud. In December 2024, Australian retailer Stan Cash suffered a data breach that exposed customer payment details, including credit card information, names, email addresses, and billing and delivery addresses.

Common Methods Used By Scammers To Steal Credit Card Data

- … That’s’ where things like 3DS 2.0 and tokenization really come into play.

- There are some dark web monitoring services that include financial checks, but these are mostly subscription based.

- Skilled hackers can take the stolen credit card number and replicate it onto a blank card using specialized equipment.

- Information and Privacy Commissioner Angelene Falk urged all organisations to review their handling of personal information and data breach response plans.

- As one of the prominent platforms supporting such activities, card shops make carrying out such scams relatively easy and popular.

- A covert communication app used by US government officials to archive encrypted messages has been compromised.

The breach originated from unauthorized access to a cloud database hosted by a third party provider, believed to be Snowflake, though Snowflake has denied involvement. In June 2024, the hacking group IntelBroker claimed responsibility for multiple cyberattacks, including breaches of Apple and AMD. Department of the Treasury disclosed a cybersecurity breach attributed to a state-sponsored actor from the People’s Republic of China. The attackers exploited a vulnerability in a third-party service, BeyondTrust, gaining access to unclassified documents and remotely accessing workstations. WK Kellogg disclosed a data breach on April 4, 2025, involving its use of Cleo’s file transfer platform for HR file transfers.

Dark Web Credit Cards: Understanding The Risks And Methodologies

- In addition to PayPal account balances, they can also transfer money from any connected bank accounts or credit cards.

- “There are sites out there where they ‘rack and stack’ them, and say how much exactly a specific card is worth,” agrees Wilson.

- In an increasingly digital world, the threat of data breaches looms larger than ever.

- However, being proactive by cancelling the compromised card, monitoring your financial statements, and setting up alerts can mitigate the risks.

- Even if this “free sample” of credit card and debit card numbers is mostly just an attempt to gain attention in the cybercrime underground, the leak contains data that could still be useful for scammers, researchers say.

Some of the offers on this page may not be available through our website. Experian is a globally recognized financial leader, committed to being a Big Financial Friend—empowering millions to take control of their finances through expert guidance and innovative tools. As a trusted platform for money management, credit education, and identity protection, our mission is to bring Financial Power to All™. Internet criminals buy and sell personal data on the dark web to commit fraud. In July 2025 Allianz Life disclosed a breach affecting 1.4 million United States customers through a third party CRM platform. Around the same time Qantas revealed a contact center breach impacting up to six million customers, caused by social engineering on external IT systems.

How Technology Is Evolving To Counter Card Fraud On The Dark Web

This adaptability underscores the ongoing challenge faced by financial institutions in combating the ever-evolving threat of dark web credit card marketplaces. Much like the situation after Silk Road was taken down, out of the ashes of Joker’s Stash, we have seen dozens of new carding data providers crop up, some specializing in particular regions or types of card data. These days, criminals use a variety of methods to steal credit card numbers without ever needing a physical card. Learn about some of the most common techniques and join LifeLock Ultimate Plus for credit card transaction alerts and other fraud detection and identity theft protection features.

Darkweb Market BidenCash Gives Away 12 Million Credit Cards For Free

Japan, the UAE, and Europe have the most expensive identities at an average of $25. Due to limited data on credit cards from other countries, we were unable to adequately compare prices for credit cards from different places. You can also limit your risk by being picky about your ATMs, where criminals sometimes install card skimming devices. These are hard to detect, but only using ATM machines inside banks or other physical buildings offers some protection, Thomas says.

US Department Of The Treasury Breach

Between June and August 2024, Japanese publisher Kadokawa and its video-sharing platform Niconico suffered a ransomware attack by the Russian-linked hacker group BlackSuit. One of the main challenges has been inconsistent cooperation across crypto platforms. The exchange eXch allowed over $90 million to be moved through its systems before taking action. While ByBit’s CEO Ben Zhou emphasized that no customer funds were affected and the firm has replenished the stolen amount through investor loans, the company launched a Lazarus Bounty program. The attackers secretly altered a digital wallet address, redirecting 401,000 Ethereum coins to their own wallet.

Using a list of 500 million email addresses, they identified over 15 million users and compiled data including email addresses, names, usernames, and activity logs. In January 2024, Indian ISP Hathway was breached by a hacker known as “dawnofdevil,” exploiting a vulnerability in the Laravel framework. While the attacker claimed access to data of over 41 million customers, analyses suggest approximately 4 million unique records were affected. In late February, UnitedHealth Group’s technology unit, Change Healthcare, was hit by a devastating ransomware attack that exposed the private health information of over 100 million Americans. The BlackCat (ALPHV) ransomware gang perpetrated the attack, which stands as the largest healthcare data breach in U.S. history.

Don’t Have An Account?

Cyble researchers noted that threat actors claimed that 27 percent, according to a random sampling of 98 cards, are still active and can be used for illegal purchasing. Most of use just have the standard personal account, but Premier and Business accounts also exist, and are up for sale on the dark web. But those tiers don’t have much influence on dark web prices, which are largely governed by account balance. In a similar study earlier this year, we noted an average price of 3.13 cents per dollar in the account. So unlike credit cards, prices for PayPal accounts and transfers have gone up during the pandemic by 293 percent.

SAP NetWeaver Breach: 581 Critical Systems Compromised By China-Linked APTs

After hackers collect this info, they post it to one of the dark web marketplaces where it can be sold. The leaked data from the BriansClub hack showed that stolen cards from U.S. residents made criminals about $13 to $17 each, while those outside the U.S. sold for up to $35.70, Krebs reported. When hundreds or thousands are bought at once, that becomes a lucrative crime.

Interestingly, a major part of the carding ecosystem revolves around education. There’s a wealth of information shared among carders—from how to bypass anti-fraud systems to practical guides on using stolen credit cards—all of which helps keep the ecosystem active and evolving. Large-scale data breaches at retailers, financial institutions or other companies can expose millions of customers’ credit card numbers to hackers. In July 2024, Holt Group, a machinery and construction company based in Texas, reported a data breach affecting 12,455 individuals.

The hackers disrupted claims processing for months and stole extensive data including names, contact info, Social Security numbers, and medical records. UnitedHealth began notifying affected individuals over the summer and cooperated with government regulators on the response. A U.S. state government agency fell victim to a multi-stage cyber intrusion enabled by leaked employee credentials. Hackers obtained a former employee’s administrator login (likely from a prior breach) and used it to access the agency’s VPN and internal network.